5 Essential Money Management Tips for Beginners

Money management is crucial for achieving financial stability and long-term success. Whether you’re just starting to budget or planning for future investments, having a solid understanding of how to manage your finances is key to reaching your goals. This guide is designed to help beginners understand the foundational principles of effective money management.

What is Money Management?

At its core, money management is about tracking and controlling your finances, which includes budgeting, saving, and investing. It’s the process of managing your money in ways that allow you to meet both short- and long-term goals while working toward financial independence. Below are some core areas to focus on to set yourself up for success:

- Budgeting

- Saving

- Investing

- Debt Management

- Retirement Planning

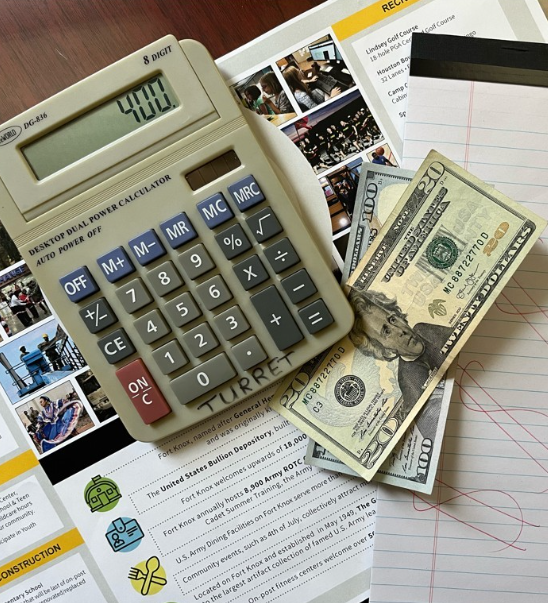

Budgeting: The Key to Financial Control

Budgeting is the process of creating a plan to ensure your income covers your expenses, both in the short and long term. It acts as a roadmap for where your money goes and helps you avoid overspending. A well-planned budget helps you prioritize financial goals, track your spending, and achieve financial independence. Here are some tips to help you get started:

- Know Your Income

Start by calculating your total income, including salary, side jobs, and any passive income like investments or rental income. Always consider your net income (after taxes) for an accurate budget. - Track Your Spending

Keep a detailed record of where your money goes. Categorize expenses into fixed (like rent or utilities) and variable (such as groceries or entertainment). You can use financial apps or software to make this easier. - Set Clear Financial Goals

Define your short-term and long-term goals, whether it’s building an emergency fund, buying a house, or saving for a vacation. These goals give you direction and motivation. - Create Your Budget Plan

With your income and expenses in mind, make a plan that allocates funds to various categories. Ensure that your total expenses do not exceed your income. - Review and Adjust Regularly

Your budget should evolve with your financial situation. Review it frequently and make adjustments as needed to stay on track with your goals.

Saving: Creating a Financial Safety Net

Saving money helps you build a financial cushion for emergencies and larger future purchases, reducing the need to rely on credit. Here’s how to develop a strong saving habit:

- Pay Yourself First

Make saving a priority by setting aside a portion of your income for savings before spending on anything else. Automating this process ensures you don’t forget. - Build an Emergency Fund

Aim to save enough to cover three to six months of living expenses. This fund acts as a safety net for unexpected situations like medical bills or job loss. - Use High-Yield Savings Accounts

Consider putting your savings in a high-yield account to earn better interest, helping your money grow faster. - Save for Specific Goals

Whether it’s a down payment for a house or a dream vacation, having dedicated savings for specific goals keeps you focused and disciplined.

Investing: Building Wealth Over Time

Investing is one of the most effective ways to grow your wealth over time. It involves putting your money into assets that can generate returns. Here are a few essential guidelines for beginners:

- Understand Risk and Return

Every investment carries some level of risk, and generally, higher risk comes with the potential for higher returns. Make sure you understand the risks involved and diversify your investments to reduce them. - Start Early

The earlier you begin investing, the more your money can grow due to the power of compound interest. Starting early often outweighs trying to time the market. - Educate Yourself

Learn about different investment options, such as stocks, bonds, mutual funds, and real estate. Use reliable resources, attend workshops, or consult with a financial advisor to get informed. - Think Long-Term

Stay committed to your investment strategy through market fluctuations. A long-term perspective is often the key to substantial returns. - Make Regular Contributions

Consistently contributing to your investment account, even if it’s a small amount, can result in significant wealth accumulation over time.

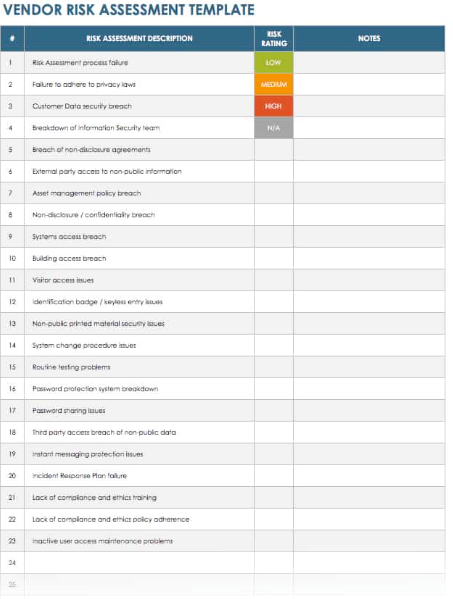

Debt Management: Keeping Financial Stress in Check

Managing debt is crucial for maintaining good financial health. Paying off high-interest debt quickly and avoiding unnecessary borrowing helps ensure financial stability. Here are some tips for managing debt:

- Differentiate Between Good and Bad Debt

Not all debt is harmful. Mortgages or student loans can be considered “good” debt if they contribute to your wealth, whereas high-interest credit card debt falls under “bad” debt. - Pay Off High-Interest Debt First

Prioritize paying off high-interest debt, such as credit cards, to reduce the burden of interest payments. - Consider Debt Consolidation

If you’re overwhelmed by multiple debts, consolidating them into one loan with a lower interest rate may simplify repayment and save money. - Monitor Your Credit Utilization

Keep your credit utilization ratio below 30% to maintain a good credit score and improve your chances of securing loans with favorable terms. - Be Cautious About New Debt

Before taking on new debt, evaluate whether it’s necessary and whether you can comfortably repay it without sacrificing your financial goals.

Retirement Planning: Securing Your Future

Planning for retirement ensures that you will have financial security when you’re no longer working. Here are some important strategies to keep in mind:

- Start Saving Early

The earlier you begin saving for retirement, the more time your investments have to grow, thanks to compounding interest. - Use Retirement Accounts

Take advantage of retirement accounts like 401(k)s, IRAs, and pension plans. Contribute regularly and, if possible, take advantage of employer matches. - Diversify Your Investments

Spread your investments across different asset classes to minimize risk and ensure steady growth. Consulting a financial advisor can help you create a diversified portfolio that aligns with your retirement goals. - Adjust Contributions Over Time

Review your retirement savings regularly and increase contributions as your income grows. This will help ensure you stay on track to meet your goals. - Plan for Healthcare Costs

Healthcare can be a significant expense in retirement. Consider saving for healthcare needs through health savings accounts (HSAs) or long-term care insurance.

Money management is an ongoing process, and it’s important to keep learning as new financial strategies and tools emerge. Financial literacy is essential for making the most of your earnings. If you ever feel unsure, seeking advice from a financial professional can provide personalized guidance and help you reach your financial goals.

English

English