Smart Ways to Save for a Down Payment on a House

Buying a home is a major financial decision, and one of the biggest hurdles for many buyers is saving for the down payment. If you’re wondering how to accumulate the funds for this important milestone, you’re not alone. The good news is that with a strategic savings plan, you can reach your goal. In this post, we’ll discuss the significance of the down payment, offer useful tips to help you save, and explore ways to make the most of your budget.

Why is a Down Payment Crucial?

A down payment is a lump sum paid upfront toward the purchase of your home. It represents a percentage of the home’s price and is essential in securing your mortgage. The more you can put down initially, the better your mortgage options will be. A larger down payment could lead to lower interest rates, smaller monthly payments, and potentially no requirement for private mortgage insurance (PMI) if it’s at least 20%. While 20% is often considered ideal, there are alternatives such as FHA loans that offer down payments as low as 3.5%. However, these loans may come with additional costs like PMI.

7 Practical Tips for Saving for a Down Payment

Here are some effective strategies to help you save for your dream home:

1. Open a Separate Savings Account

Keep your down payment savings separate from your regular account to stay organized. A high-yield savings account allows your savings to grow with interest. To stay disciplined, consider setting up automatic transfers from your checking account to your savings. This approach ensures that you consistently contribute without having to think about it.

2. Set Clear, Achievable Goals

To save effectively, break down the total amount needed for your down payment into manageable monthly goals. For example, if you plan to buy a $300,000 home, a 20% down payment would require $60,000. Breaking this number into smaller monthly targets can make the process feel more attainable and keep you motivated.

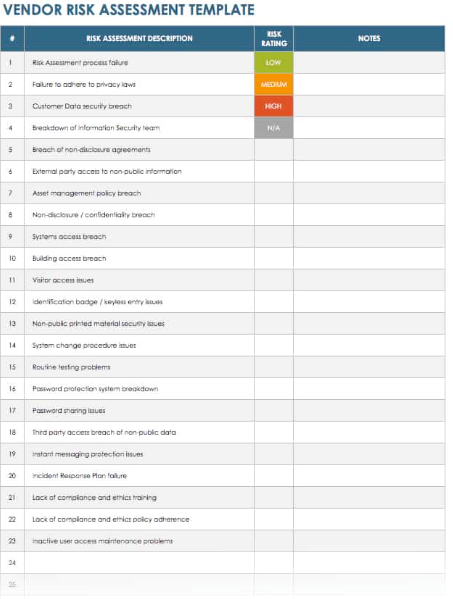

3. Track Your Spending and Budget

Review your monthly expenses to identify areas where you can cut back. Whether it’s dining out less, canceling subscriptions you don’t use, or adjusting your shopping habits, rechanneling that extra money into your down payment fund can make a big difference. Tools like budgeting apps or simple spreadsheets can help you see exactly where your money is going.

4. Eliminate Unnecessary Expenses

Cutting out small luxuries can significantly boost your savings. For instance, canceling streaming services or skipping a gym membership can free up cash. Look for low-cost alternatives that don’t sacrifice your quality of life, like home workouts or meal prepping. This extra cash can be directly funneled into your savings.

5. Pay Down Debt and Avoid New Debt

Reducing high-interest debt, like credit card balances, can help you free up more money to save. Additionally, paying down debt improves your credit score, which can get you a better mortgage rate. Avoid taking on new debts while saving for a home, as it can impact your mortgage eligibility and slow down your progress.

6. Explore Down Payment Assistance Programs

Many states and local governments offer down payment assistance to first-time buyers. These programs can provide grants or low-interest loans to make buying a home more affordable. For example, the Michigan State Housing Development Authority (MSHDA) offers assistance up to $10,000 for qualified buyers. Check if your state or local area offers similar support to help you with your down payment.

7. Consider Side Jobs or Freelance Work

If you want to speed up your savings, consider taking on a part-time job or freelance work. Whether it’s driving for a rideshare service, doing freelance writing, or selling items you no longer need, any extra income can be directly put into your down payment savings. Side gigs can add up quickly and help you reach your savings goal faster.

Saving for a Down Payment While Renting

Renting can provide flexibility, but owning a home allows you to build equity. If you’re currently renting but planning to save for a home, here are some tips to help you save:

1. Downsize Your Rental

If you’re struggling to save while renting, consider moving to a more affordable place. Downsizing can significantly reduce your monthly rent, allowing you to put that extra money toward your down payment fund.

2. Find a Roommate

Having a roommate can help drastically reduce your living costs. By sharing rent and utilities, you’ll be able to save much more each month. This extra money can go straight into your down payment savings, accelerating your path to homeownership.

Final Thoughts

Saving for a down payment may feel like a daunting task, but with a clear plan, it’s entirely achievable. By setting goals, tracking your spending, and making conscious efforts to cut back on unnecessary expenses, you can steadily build your savings. Whether you’re making small sacrifices or finding additional income streams, every step you take brings you closer to owning your own home.

English

English