How No Monthly Fee Business Checking Accounts Can Save Money for Small Businesses

For small business owners, effectively managing cash flow and expenses is crucial for financial success. A key aspect of managing finances is choosing the right checking account for everyday banking needs. Traditional business checking accounts often come with monthly maintenance fees, which can quickly add up and put a strain on a small business’s budget. However, no-monthly-fee business checking accounts offer a valuable opportunity to reduce expenses and streamline financial management.

By opting for a no-monthly-fee business checking account, business owners can save money while ensuring their banking operations remain simple and efficient. Let’s explore the benefits of these accounts and how they can help small businesses thrive.

The Advantages of No-Monthly-Fee Business Checking Accounts

No-monthly-fee business checking accounts come with numerous benefits that make them a great choice for small business owners:

1. Cost Savings

The most obvious benefit of no-monthly-fee business checking accounts is the savings. Without monthly maintenance fees, small businesses can free up funds for other areas of the business, like expansion or reinvestment. These savings can add up significantly over time.

2. Stable Financial Planning

Since there are no monthly fees to worry about, small business owners can predict their banking costs more accurately. This predictability makes it easier to plan and budget effectively, leading to better financial control and stability.

3. Convenient Access

No-monthly-fee business checking accounts typically offer all the essential features found in traditional accounts, such as online banking, mobile access, and ATM usage. This ensures that business owners can manage their finances easily, no matter where they are.

4. Flexibility

These accounts are often more flexible than traditional ones, with fewer restrictions. Business owners can tailor the account to their unique needs, ensuring that they only pay for the services they require without being tied to unnecessary fees.

5. Peace of Mind

Knowing that there are no monthly fees associated with their business checking account allows owners to focus more on running their businesses. The removal of monthly charges means less stress and more freedom to achieve business goals.

What to Keep in Mind When Choosing a No-Monthly-Fee Business Checking Account

While these accounts offer many benefits, it’s essential to consider several factors when selecting the best one for your business:

1. Deposit Requirements

Some no-monthly-fee accounts might require a minimum balance to avoid fees. It’s crucial to check these requirements and ensure your business can meet them before committing to the account.

2. Transaction Limits

Many no-monthly-fee accounts limit the number of transactions per month. If your business has high transaction volumes, you’ll need to make sure that the account’s limits fit your needs to avoid extra charges.

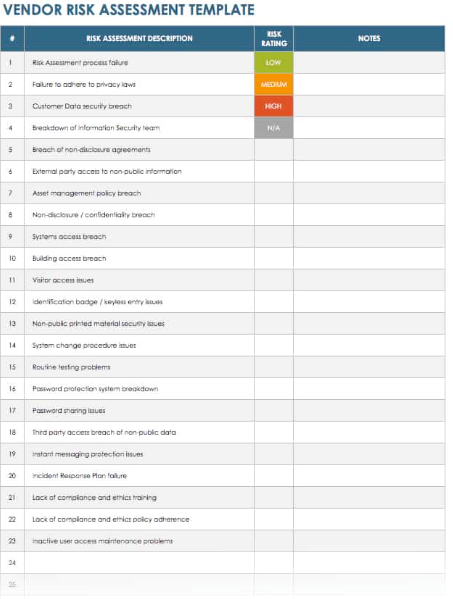

3. Other Fees

Even though monthly maintenance fees may be waived, other charges, like overdraft fees or wire transfer fees, could apply. Review all possible fees to avoid unexpected costs down the line.

4. Account Features

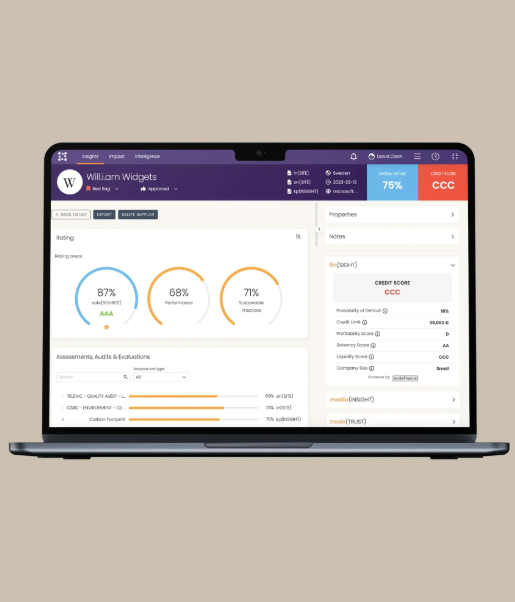

Look for accounts that offer useful features, such as online banking, mobile apps, bill pay services, and easy access to customer support. A well-rounded account can simplify your business’s financial management.

5. FDIC Insurance

Make sure the account is with an FDIC-insured institution. This protection ensures that your deposits are secure up to the insured limits, providing peace of mind for your business.

Tips to Maximize the Benefits of No Monthly Fee Business Checking Accounts

To make the most of a no-monthly-fee business checking account, consider implementing these strategies:

1. Maintain the Minimum Balance

If the account requires a minimum balance to avoid fees, ensure that your business consistently meets this threshold. Keeping a steady balance helps you avoid unnecessary charges while enjoying all the benefits of the account.

2. Keep Track of Transactions

Regularly monitor your account activity to stay within transaction limits. Tracking your expenses helps you avoid additional fees, ensuring that the account remains cost-effective.

3. Automate Payments and Deposits

Automating financial tasks, such as deposits and bill payments, ensures smooth cash flow management. This not only reduces the risk of late payments but also saves time and effort in managing finances.

4. Opt for Electronic Statements

Switching to electronic statements eliminates the costs of printing and mailing paper statements. Digital statements are not only more environmentally friendly but also more convenient and accessible.

5. Leverage Online and Mobile Banking

Utilize the convenience of online and mobile banking to manage your account on the go. Whether you’re making transfers, checking balances, or paying bills, these tools enhance your ability to manage finances efficiently.

Conclusion

For small businesses looking to reduce expenses and simplify banking, no-monthly-fee business checking accounts are an excellent option. By eliminating monthly maintenance charges, these accounts allow business owners to focus on growing their business rather than worrying about fees. With thoughtful consideration and proactive management, small business owners can take full advantage of these accounts to boost their financial health and achieve long-term success.

English

English